TMX POV - TSX Venture Exchange’s CPC Program Facilitating Connections for Capital and Opportunity in Latin America

TSXV marks a milestone with their first CPC Roadshow in Brazil and Argentina

As the global economy accelerates its shift toward cleaner, technology-driven growth, early-stage companies in Latin America — particularly in critical minerals, cleantech, and innovation — are seeking better access to capital. TSX Venture Exchange (TSXV) offers a powerful go-public opportunity under the Capital Pool CompanyⓇ (CPC) Program. The recent inaugural roadshow in São Paulo and Mendoza marked a milestone in this effort, bringing together Canadian investors, CPC founders, and high-potential ventures from Brazil, Argentina and Chile.

South America is a key jurisdiction for Toronto Stock Exchange (TSX) and TSXV, and our commitment remains strong: connecting opportunities with capital and fostering long-term growth for companies in the region. Currently, TSX & TSXV issuers operate 297 critical mineral properties in South America, of which 28 are situated in Brazil and 59 in Argentina. Fourteen of those issuers started as CPCs.

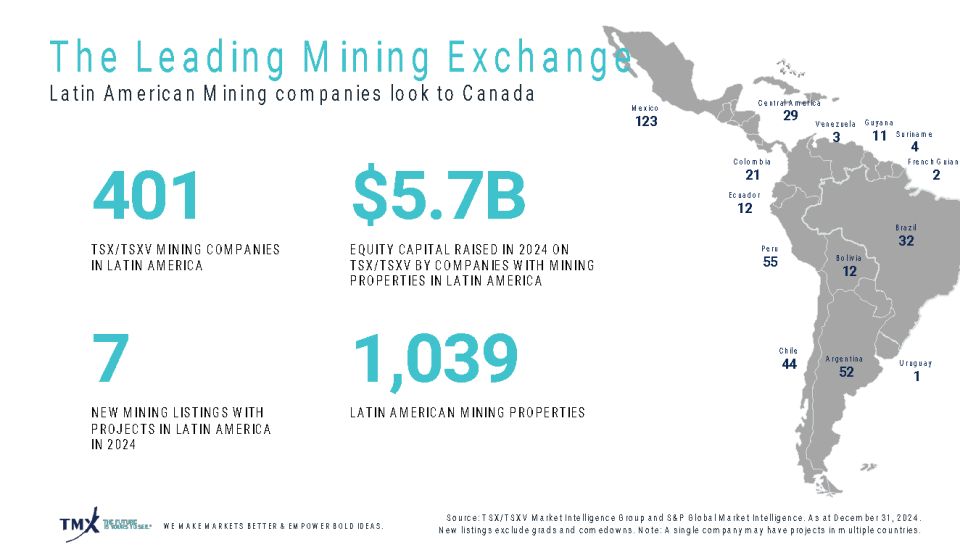

TSX and TSXV are a leading mining exchange group in Latin America:

In this Q&A, we explain why CPCs matter, how they work, and what they can unlock for Latin America's emerging leaders.

Q: Why was this CPC Roadshow significant for Latin America?

GL: This was TSXV's first-ever CPC roadshow in Latin America, with stops in São Paulo and Mendoza. It created a unique opportunity for dialogue between Canadian investors and early-stage Latin America companies, particularly in mining, cleantech, and renewable energy. Brazil, Argentina and Chile, rich in critical minerals such as lithium and copper, are essential to the global energy transition — but early-stage capital remains a challenge. The CPC Program may address that gap.

Q: What is the CPC Program, and how does it work?

GL: The Capital Pool Company (CPC) Program is a unique Canadian, two-phased pathway to going public:

- Phase 1: A group of experienced capital markets professionals forms a CPC — a listed shell company with no operations, but capital (up to $10 million) and over 200 shareholders.

- Phase 2: The CPC completes a Qualifying Transaction (QT) by acquiring an operating business — often in mining, innovation or cleantech. The result is a fully operational public company with better access to capital and TSXV governance standards.

Since inception over 20 years ago, over 2,700 CPCs have been launched, with more than 90% completing QTs. The resulting issuers have raised over $75 billion in equity.

Q: What makes the CPC Program well-suited to Latin America?

GL: In regions like Argentina, Chile and Brazil, geological potential is vast — but companies often struggle with access to early-stage risk capital and public market entry. CPCs can offer:

- A faster, more cost-effective route to go public than a traditional initial public offering (IPO)

- Canadian governance and regulatory credibility of TSXV

- Seasoned CPC directors and investors who support growth and scale

The CPC Program can be more than a financing tool — it can be a bridge between local potential and global capital.

Q: How is a CPC transaction different from an IPO?

GL: A traditional IPO involves extensive filings with both securities regulators and the exchange, and can be time-consuming, expensive, and more vulnerable to market shifts. A CPC QT can:

- Bypass the need for an operating business at the time of listing of the CPC

- Allow early engagement with accredited investors

- Involve review by fewer regulatory bodies upfront (primarily TSXV)

- Offer shared cost and workload between the CPC and the private company

It's essentially an M&A transaction plus financing, allowing the private company to gain control of the resulting public entity.

Q: How does the Qualifying Transaction work in practice?

GL: Here's a simplified step-by-step:

- Target Match: A private company identifies a CPC with aligned interests and capital.

- Negotiation: Both parties agree on valuations, structure (often a share exchange), and potential concurrent financing.

- Disclosure & Review: A detailed Disclosure Document is prepared, including audited financial statements.

- TSXV Review: TSXV reviews the transaction for compliance with its policies.

- Closing: Upon approval, the deal closes and the Resulting Issuer starts trading.

Concurrent financing typically injects new capital. Securities are often escrowed and released gradually post-closing.

Q: What was the feedback from local leaders about the CPC opportunity?

GL: Mendoza's Minister of Energy and Environment, Jimena Latorre, highlighted that "geological wealth is not enough — access to capital must match." She emphasized the CPC's potential role as a cross-border financing model that can unlock sustainable growth and position Mendoza as a mining finance hub.

Q: Beyond mining, where else can CPCs be used?

GL: While mining can be a natural fit, CPCs can also be ideal for tech, cleantech, life sciences, and other sectors where early-stage capital is scarce. The flexibility of the model can allow for listings of high-growth companies from a wide range of industries.

Q: What's next for the CPC program in Latin America?

GL: The roadshow marks a long-term commitment for the region. TSXV is not only showcasing a proven financing pathway — they're building partnerships. This Latam Roadshow was an opportunity to connect Canadian CPC founders with over 27 companies and key stakeholders from Brazil, Argentina and Chile.

With 14 CPC-born issuers already operating critical mineral projects in South America, the momentum is clear. The CPC Program will continue to evolve as a potential strategic vehicle for early-stage growth, regional integration, and sustainable development across Latin America.

Looking Ahead: Building a Bridge Between Capital and Growth

The CPC Program can be more than a financial mechanism — it's a bridge between entrepreneurial talent and global capital. For Latin American companies ready to scale, and for Canadian investors seeking long-term growth in high-impact sectors, the CPC program presents an opportunity for connection. TSXV remains committed to supporting this connection. The roadshow was just the beginning. We look forward to deepening partnerships across the region and helping the next generation of public companies thrive on the world stage.

Guillaume Légaré

Head, Business Development, South AmericaToronto Stock Exchange and TSX Venture Exchange

guillaume.legare@tmx.com

Follow Guillaume on LinkedIn

Copyright © 2025 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this article, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This article is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. Capital Pool Company, TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, TSX Venture Exchange and TSXV are the trademarks of TSX Inc. All other trademarks used herein are the property of their respective owners.