TMX POV - What is holding back investment in Canadian critical minerals?

The Canadian Climate Institute, in collaboration with TMX Group, surveyed a wide range of players in the critical minerals ecosystem on the barriers to investment across the critical minerals value chain

By Ariane Bourassa and Jonathan Arnold

As the global energy transition accelerates, demand for critical minerals is growing rapidly. The race to secure access to critical minerals such as copper, nickel, and lithium is shaping the industrial competitive landscape, and governments around the world are forming alliances and crafting policies to secure their supplies of critical minerals. By one recent estimate, Canada must increase its investment in new critical mineral mining by $30 billion by 2040 to become a major player in this growing sector.1

But as a recent survey of market participants makes clear, significant barriers stand in the way.

The Canadian Climate Institute, a leading climate change policy research organization, is undertaking new research to explore investment barriers across the critical minerals value chain, and the role of government policy in addressing these barriers. In collaboration with TMX Group, operator of global markets, including Toronto Stock Exchange and TSX Venture Exchange, the Institute surveyed 174 representatives from a wide range or organizations across the critical minerals eco-system to understand what's standing in the way of Canada building high-quality, responsible critical mineral mining projects (see box below for more details on the survey methodology).

Box 1: Canadian Climate Institute's Survey Methodology

|

The survey was designed to uncover what the investment barriers are, how these barriers vary across the value chain, and the tensions between advancing investment while meeting social and environmental objectives. To have a good understanding of the different barriers, the survey targeted a wide range of organizations in the critical minerals ecosystem, including exploration and mining companies, institutional investors, industry associations, government departments, environmental organizations, and academic researchers. In total, the survey had 174 , 68 per cent C-suite or senior management, from companies that work directly in the critical minerals value chain, representing projects that cover every province and territory across Canada. It is worth noting that the survey sample is not representative of the full range of perspectives around critical mineral projects. In particular, it includes limited responses from Indigenous rights holders and organizations. |

Below is a preliminary overview of key insights from the survey. In early 2025, the Canadian Climate Institute will publish a comprehensive report with detailed analysis and policy recommendations to address the financing gap, as well as the social and environmental hurdles the growing sector must overcome.

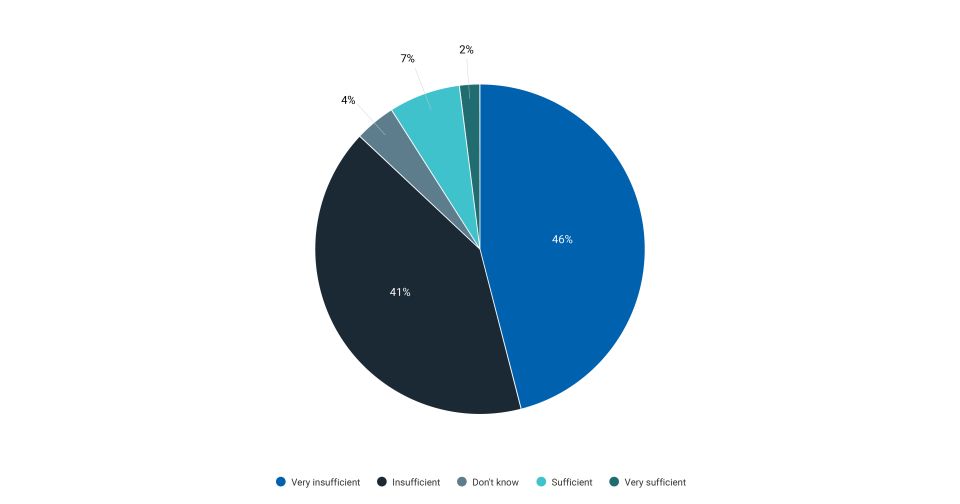

The current level of investment in Canada's critical minerals value chain is insufficient

This was the question on which respondents were most aligned—87 per cent agreed that the current level of investments is "insufficient" or "very insufficient" to grow Canada's critical minerals value chain. That number was even higher among respondents in the financial sector, with all respondents rating current investment levels as "insufficient" or "very insufficient."

The financing gap is most significant in upstream exploration and extraction

The majority of respondents (63 per cent) rated the upstream exploration and extraction segments of the value chain to have the most significant financing gap. A similar proportion (65 per cent) responded that government policy has the potential to make the biggest impact on upstream mining extraction. Only three per cent of respondents viewed the financing gap in downstream manufacturing (e.g., battery cells; electric vehicles) as the most significant.

Permitting delays, lack of infrastructure, and lack of clarity around Indigenous rights and title rank as top project-level barriers

The survey asked respondents to rate potential barriers to increasing investment at the project level, on a scale from "very minor" to "very major." Delays in permitting and regulatory review processes topped the list, with 79 per cent of respondents rating it a "very major" or "major" barrier.

The lack of infrastructure, such as roads and access to power, for remote projects was the second highest-rated barrier, with 66 per cent rating it "very major" or "major," followed by barriers related to lack of clarity around Indigenous rights and title (52 per cent).

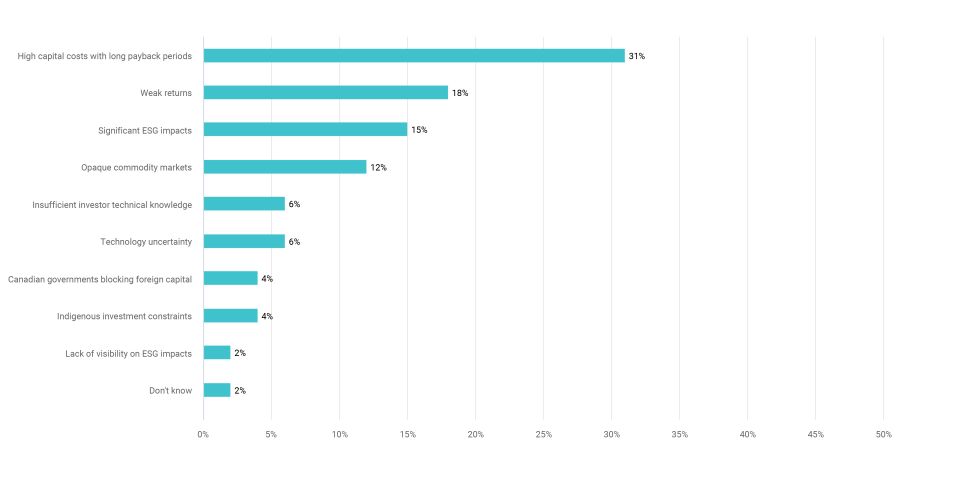

High capital costs and long payback periods are the most significant capital market barriers

When asked to identify the single biggest capital market barrier that discourages and constrains investment in the critical mineral value chain within Canada, nearly one-third of respondents (31 per cent) identified high capital costs and long payback periods.

Respondents also noted that cost overruns often undermine the ability for projects to attract and secure investment, and this is further exacerbated by price volatility and uncompetitive market behaviour from other international market participants.

Social and environmental objectives can be achieved while maintaining a globally competitive value chain

The survey asked respondents to rate the importance to investors of various social and environmental objectives – including maximizing economic and social benefits to local communities, advancing Indigenous self-determination and economic empowerment, and reducing greenhouse gas emissions. Respondents were also asked whether those objectives could be achieved while maintaining a globally competitive critical minerals value chain.

A majority of respondents (83 per cent) agreed that mitigating negative impacts to the local environment and communities is important, and 91 per cent agreed that Canada can achieve these objectives while remaining competitive.

Canada's critical mineral value chain is complex, as are the barriers holding back its growth

These survey insights highlight the complexity of Canada's critical mineral value chain and the barriers holding back its growth as global demand – and competition – grow.

To overcome those barriers, progress must be made on multiple fronts: long-term Canadian competitiveness hinges on whether the country can address both market- and project-level barriers, while simultaneously addressing the social and climate impacts of critical minerals mining projects. These barriers and challenges are interconnected, and that must be taken into account when developing strategies and policies.

At the same time, however, it is clear that not all barriers facing the critical minerals value chain warrant government policy intervention. Policymakers should prioritize resources in the areas where policy can deliver net benefits for Canadians. The forthcoming Canadian Climate Institute report will provide comprehensive analyses of the types of policy packages that can address these barriers, and mobilize capital toward high-quality, responsible critical mineral mining projects.

Ariane Bourassa, Head, Sustainability and ESG Strategy, TMX Group Limited

Ariane leads corporate sustainability for TMX Group. Her focus is on integrating ESG into the enterprise strategy, while supporting TSX and TSXV-listed companies and market participants in their sustainability journeys.

Jonathan Arnold, Acting Director of Clean Growth, Canadian Climate Institute

Jonathan is a lead author on the Institute's forthcoming report on critical minerals. He was also a lead author and contributor to the Sustainable Finance Action Council's roadmap report to create a green and transition taxonomy in Canada.

Jonathan Arnold

Acting Director of Clean Growth,Canadian Climate Institute

Follow Jonathan on LinkedIn

Footnote

1 Canada's Energy Transition Will Demand $16 Billion Worth of Critical Minerals by 2040, Canadian Climate Institute, Calvin Trottier-Chi, August 9. 2024, https://440megatonnes.ca/insight/canada-critical-minerals-clean-energy-transition/

Copyright ©2024 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this publication without TSX Inc.'s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies ("TMX Group") guarantees the completeness of the information contained in this publication, and TMX Group is not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX, the TMX design, Groupe TMX, TMX Group, Toronto Stock Exchange, TSX, TSX Venture Exchange and TSXV are the trademarks of TSX Inc.