TMX POV - “Going Public Considerations: A Checklist for U.S. Companies”

These are incredibly robust times in the public markets with high numbers of not only initial public offerings (IPOs) and financings across North American markets but also the rise in popularity of Special Purpose Acquisition Corporations (SPACs) in the U.S. As such, high growth companies are likely wondering whether going public is right for them, especially if they are being approached by SPACs with favorable, if not unbelievable, valuations.

But how do you decide if and when going public is right for your company, and which is the best market to list? Here are some key considerations to think about.

1. REASON: Does my company have a reason to be public and would it take advantage of the benefits of being a public company? Should my company go public in Canada?

Reasons to go public as a high growth company:

- Access to permanent capital with the ability to go back to the market for subsequent rounds

- Ability to facilitate growth by using public shares as acquisition currency versus direct cash offerings

- Diversify shareholder base and flatten the capital table (public shareholders typically hold common versus preferred shares)

- Provide a path to liquidity for early investors and employees

- Create an incentive mechanism for employees

- Take advantage of an alternative to private venture capital with the potential to maintain greater control

- Increase visibility and prestige by being listed on a recognized stock exchange

Reasons for a U.S. company to go public in Canada:

- An alternative path to a U.S. exchange, with the possibility of taking advantage of the streamlined dual-listing path through the Multi-Jurisdiction Disclosure System (MJDS)

- Possible opportunity to avoid SEC registration and register as a Canadian reporting issuer subject to Canadian continuous disclosure requirements and Canadian corporate governance requirements under Canadian securities laws

- Access to pools of capital in Canada, the U.S. and globally

- Possible investor interest for new companies of similar size and/or sectors to those already listed

- Directors & Officers (D+O) insurance that can be less expensive than for U.S. public companies

- Efficient access to the Canadian short form and base shelf prospectus system, which could make it easier to access subsequent capital

2. READINESS: Is my company ready to go public and be public? A non-exhaustive list of factors to consider:

- Management Team: a management team interested and ready to go public, including a CFO with public company experience

- Board of Directors: a formal board of directors that understands its legal and fiduciary responsibilities as public company directors

- Audited Financials: audited financial statements are required

- Internal Controls: financial controls and a reporting infrastructure that comply with regulatory requirements

- Time for Investor Relations: an understanding of the time that senior management will need to spend on communicating with current and potential investors

- Transparency: the company's financial information will become public to everyone, including competitors

3. EQUIREMENTS: Does my company meet exchange listing requirements?

Each stock exchange has its own listing requirements that must be met to list on that market. In the U.S., the major exchanges have requirements for, among other things, minimum share price, market capitalization, and shareholder equity. In Canada, TSX and TSXV have options for small cap growth companies, and include listing criteria based on, among other things, financial fundamentals including working capital, revenue, and net tangible assets.

As a regulated junior market, TSXV lists early stage and even pre-revenue companies. The intention is to provide sufficient investor protection through disclosure and corporate governance, while recognizing the reality of being a small public company and the need to access capital.

See the Guide to Listing here and the US Issuers Legal and Tax Guide here for more details.

4. REALITY: Is there investor interest for my type and size of company in current market conditions? Is going public in Canada realistic for my company?

In today's market, Canadian investment bankers tend to look for companies raising growth versus development capital. This means that the company has developed a commercially viable product, has early customers or interest, and now needs growth capital for customer acquisition and expansion. Depending on the sector and based on the average financings of new US listings on TSXV in the last three years, companies raising at least a typical Series B round of US$5-10M are of interest.

Key considerations:

- Investor Interest: Can Canadian investment bankers get investor support for this type and size of company in current market conditions?

- Structure: Does becoming a public company regulated as a Canadian reporting issuer and subject to continuous disclosure requirements of Canadian securities law allow for cost savings compared to pursuing full registration with the SEC?

- Tax: What are the potential tax consequences for shareholders and the company?

- Valuation: Is it possible to get a reasonable and attractive valuation in current market conditions compared to private markets or U.S. public markets?

- Growth Strategy: Does going public in Canada fit with a long term growth strategy, including, if applicable, eventually listing on a U.S. exchange?

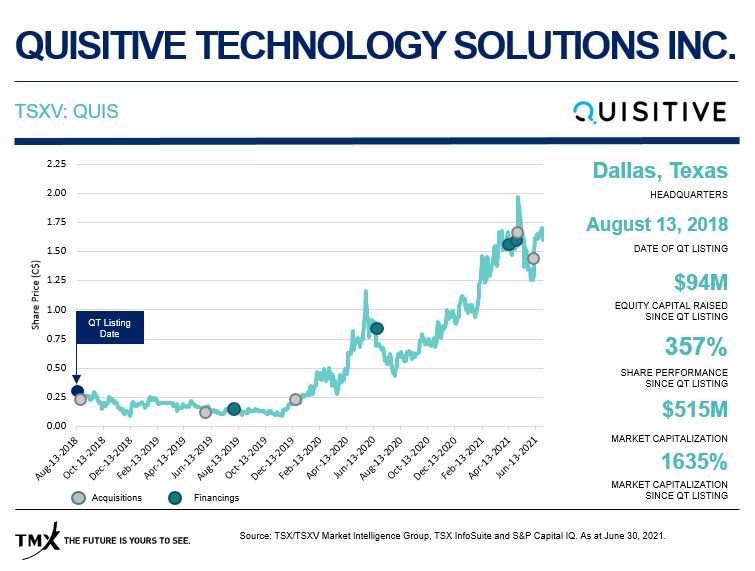

U.S. Company Highlight: Quisitive Technology Solutions Inc. (TSXV:QUIS)

Dallas-based Quisitive Technology Solutions is an example of a U.S. tech company that is using public venture capital to fuel its growth. Since listing on TSXV in 2018, Quisitive has raised CDN$94M in four financings and completed five acquisitions. Mike Reinhart, CEO, will be speaking on why they chose to list on TSX at the Austin Technology Council Leadership Dinner on August 18th. REGISTER HERE.

To see more U.S. case studies and learn more about public venture capital and going public in Canada, visit us.tsx.com. To discuss if going public is right for you, contact Delilah Panio, VP of U.S. Capital Formation, at delilah.panio@tmx.com.

Delilah Panio

Vice President, U.S. Capital Formation, Toronto Stock Exchange and TSX Venture ExchangeFollow Delilah on LinkedIn

* Unless otherwise noted, all data is sourced from the Market Intelligence Group of TMX Group as of June 30, 2021.

Copyright © 2021 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this article, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This article is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. Capital Pool Company, CPC, TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, TSX Venture Exchange, TSXV, The Future is Yours to See., and Voir le futur. Réaliser l'avenir. are the trademarks of TSX Inc. All other trademarks used in this article are the property of their respective owners.